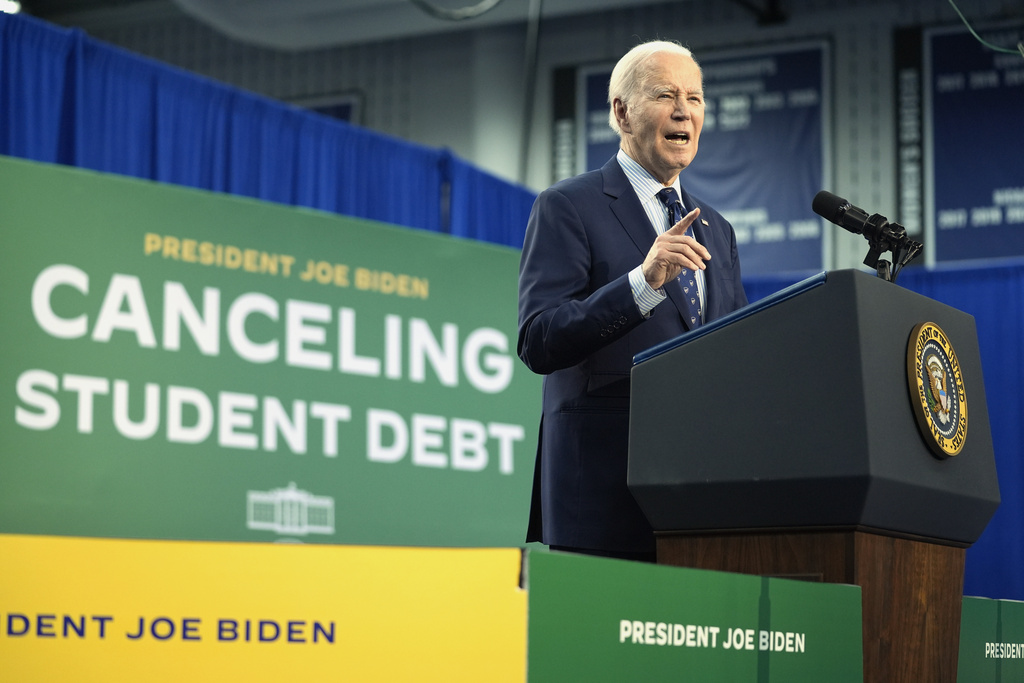

The Biden administration announced on Friday another $4.28 billion in "relief" for nearly 55,000 public service workers in jobs like firefighting, nursing and teaching after 10 years of continuous payment.

According to a fact sheet from the Department of Education, this brings the outgoing president's total loan forgiveness to "approximately $180 billion for nearly 5 million Americans."

David McGarry, policy analyst at Taxpayers Protection Alliance, does not think that is a good thing.

"There's something fundamentally wrong about asking taxpayers to pay the costs of someone else's education," he responds. "Biden has a weird fascination with student loan forgiveness."

He points out that Americans hold many kinds of debts.

"People have mortgages. People have car loans. People have some credit card debt," McGarry lists. "Somehow, student loans are the very specific type of debt that he has decided that it is his mission to erase."

Of the nearly five million borrowers who have had more than $180 billion in debt relieved by the administration, more than one million were through the Public Service Loan Forgiveness program, totaling about $78 billion, the administration said.

As AFN recently noted, the Biden administration has attempted several student loan bailouts over the past four years. The Supreme Court struck down the 2022 proposal to forgive up to $20,000 in federal student loan debt for Pell Grant recipients and $10,000 for others earning less than $125,000 annually.

The Saving on a Valuable Education plan is currently frozen due to legal challenges.

The effort to "specify the secretary's authority to waive all or part of any student loan debts owed to the Department based on the secretary's determination that a borrower has experienced or is experiencing hardship related to such a loan" could be dead on arrival.

The Biden administration maintains they want to relieve student loan debt to help people and families make ends meet, but opponents have accused Biden of trying to buy votes for himself and his party.